Meta Description:

Explore VR Bank ihn with real-life tips. Learn about accounts, online banking, loans, fees, apps, and hidden insights for stress-free banking.

1. My Initial Struggle with VR Bank ihn

When I first heard about VR Bank ihn, I assumed banking online would be simple. I was wrong. I tried VR Bank online banking, thinking it would be just like any other app. But confusion hit immediately:

-

The VR Bank login page felt complicated.

-

Using the VR Bank branch locator was frustrating because maps seemed outdated.

-

I had no idea about VR Bank fees or which VR Bank accounts fit my needs.

I made some mistakes: I accidentally tried creating multiple accounts, ignored the VR Bank app, and skipped reading the VR Bank 2025 updates. It was overwhelming, and I felt stuck.

I remember sitting there, staring at the screen, thinking, “Why is this so complicated? Am I missing something obvious?” I even considered giving up and going back to my old bank, but something inside me said, “Just figure it out step by step.” That tiny spark of determination kept me going, even though it felt like a slow process at first.

2. The Turning Point: Gaining Clarity

The breakthrough came when I decided to take things slowly, step by step.

-

I studied all VR Bank accounts, identifying which worked best for me.

-

Logging in via the VR Bank app made everything smoother.

-

Using the VR Bank branch locator properly prevented unnecessary trips.

Emotionally, the shift was huge: confusion turned into clarity, stress became confidence. I realized that focusing on small actionable steps mattered more than trying to figure everything at once.

3.Realities You Won’t Hear Often

Even after I got the hang of things, it wasn’t perfect:

-

Some VR Bank financial services took longer than expected.

-

Not every VR Bank regional office had the full digital setup.

-

Learning VR Bank digital banking properly required patience.

Being honest about these hiccups is crucial — real-life banking always has small roadblocks. At times, I felt a bit frustrated, thinking I should have figured it out faster. But looking back, these little struggles actually helped me understand the system better and avoid bigger mistakes later.

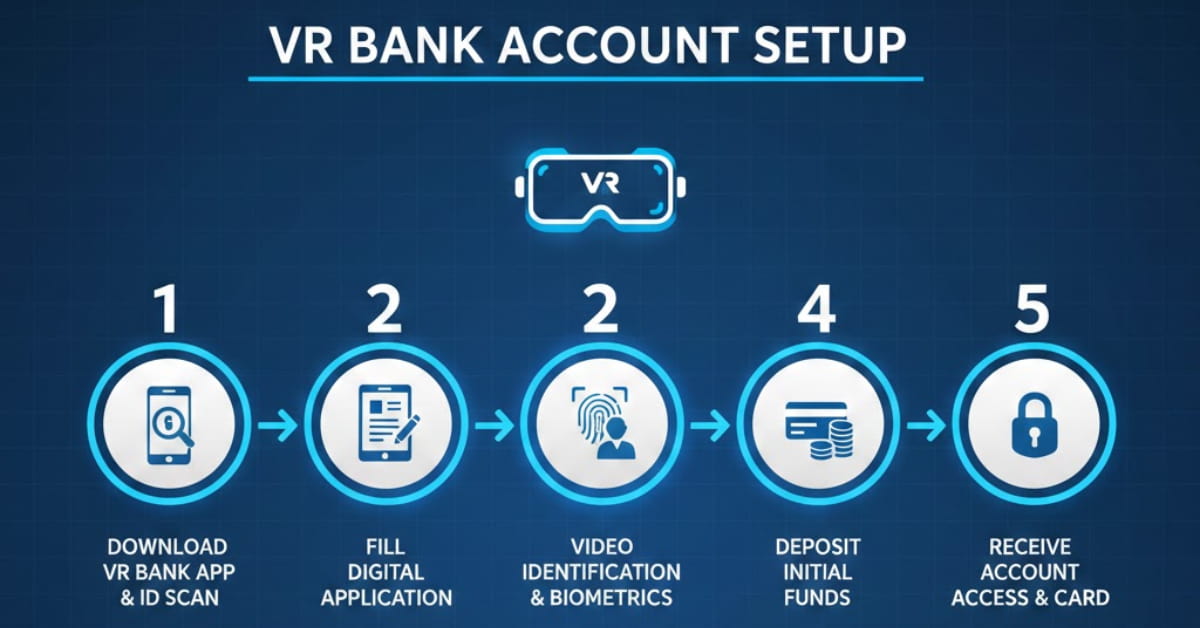

4. Step-by-Step Solution for VR Bank Services

Here’s what finally worked for me in practical terms:

Step 1: Choose the Right Account

-

Explore all VR Bank accounts.

-

Decide which type suits your needs: savings, checking, or business.

-

Check VR Bank fees carefully.

Step 2: Master Login and the App

-

Use VR Bank login on the official portal.

-

Download the VR Bank app for mobile convenience.

-

Enable notifications for important updates.

Step 3: Locate Branches and Contact Support

-

Use VR Bank branch locator to find the nearest branch.

-

Keep VR Bank contact information ready for urgent queries.

-

Reach out to VR Bank customer support if digital issues arise.

Step 4: Explore Services and Loans

-

Take advantage of VR Bank services like account management, transfers, and online payments.

-

Review VR Bank loans options if needed.

-

Track updates and new offerings in VR Bank 2025 updates.

Step 5: Leverage Digital Banking

-

Use VR Bank digital banking for easier transactions.

-

Check daily balances, transfer history, and manage finances efficiently.

Tips from Real Experience

-

Avoid skipping app updates.

-

Do not open multiple accounts unnecessarily.

-

Check VR Bank regional offices for unique services before visiting.

5. Common Mistakes to Avoid

-

Ignoring the VR Bank app and digital tools.

-

Misunderstanding VR Bank fees.

-

Overlooking branch-specific services.

-

Relying on outdated maps instead of VR Bank branch locator.

6. Hidden Truths and Insider Tips

-

Some “popular tips” about VR Bank services online are misleading.

-

Certain features in VR Bank digital banking are underused but extremely helpful.

-

Customer support response times vary; patience is key.

7.Real-Life Benefits You Might Miss

-

Faster transactions with VR Bank online banking.

-

Complete account management via VR Bank app.

-

Personalized guidance from VR Bank customer support.

-

Awareness of VR Bank 2025 updates for better planning.

What I didn’t expect was how much stress this small setup would remove from my daily routine. I started noticing that managing my money felt less like a chore and more like a task I could actually control. Even small confirmations, like getting a quick notification about a payment, gave me a surprising sense of relief and confidence.

8. Final Thoughts: Navigating VR Bank ihn with Confidence

Using VR Bank ihn doesn’t have to be stressful. Start slow, use the app, stay updated, and keep realistic expectations. Progress is gradual, and every small step counts. I remember feeling anxious at first, wondering if I’d ever get the hang of it. But over time, each small success — logging in without issues, finding the right account, or completing a transaction smoothly — built my confidence. It reminded me that patience pays off, and it’s okay to make mistakes along the way. Banking became less of a chore and more of a small, manageable part of my day.

9. FAQs About VR Bank ihn

Q1: What is VR Bank ihn?

A1: VR Bank ihn refers to a regional banking system in Germany offering accounts, loans, and digital banking.

Q2: How do I login to VR Bank online banking?

A2: Use the official VR Bank login portal or the VR Bank app with your credentials.

Q3: How can I find the nearest VR Bank branch?

A3: Use the VR Bank branch locator available on the official website or app.

Q4: What are the fees for VR Bank accounts?

A4: Fees vary by account type. Check account details and VR Bank fees listed online before opening an account.

Q5: Does VR Bank offer loans?

A5: Yes, VR Bank provides personal and business loans. Explore VR Bank loans options online or in-branch.

Q6: How can I contact VR Bank customer support?

A6: Access VR Bank contact information on their website or app for email, phone, or chat support.

Q7: What’s new in VR Bank 2025 updates?

A7: Updates include new app features, enhanced digital banking, and improved customer support options.