Discover insider tips about Rondout Savings Bank, including online banking, checking & savings accounts, mortgage rates, credit cards, and hidden insights to make smarter financial decisions.

My First Experience With Rondout Savings Bank: Confusion, Mistakes, and Realizations

When I first explored Rondout Savings Bank, I felt a mix of excitement and confusion. I needed a reliable checking account, savings account, and access to online banking, but the process wasn’t as simple as I imagined.

Walking into the Kingston, NY, branch, I was overwhelmed by multiple account types, loan options, and online banking features. I wasn’t sure which account suited my needs best.

The First Mistake I Made: I attempted to set up online banking immediately after opening my account without fully understanding the process. As a result, I faced minor errors and delays, which initially caused frustration.

Lessons I Learned:

-

Patience is crucial: Taking the time to ask questions with customer service saved me from bigger mistakes later.

-

Branch visits are invaluable: Some processes and questions are easier to handle in person than online.

By the end of that first visit, I realized that firsthand experience is often more effective than reading FAQs or website information alone.

From Doubt to Confidence: How I Navigated Checking, Savings, and Online Banking

Initially, I felt unsure about which account type to choose. Should I open a checking account, a savings account, or both? How exactly did the mobile app work?

Here’s what helped me gain clarity:

-

Checking account: Perfect for daily transactions, debit card usage, and bill payments.

-

Savings account: Ideal for accumulating interest and saving toward long-term financial goals.

-

Mobile app: Provides real-time account monitoring, deposit services, and quick transfers.

Real Imperfection: The mobile app gave an error message initially, causing minor stress. However, Rondout Savings Bank’s customer service resolved it within 24 hours.

This experience taught me that even the most reliable banks can have minor hiccups, but persistence and communication solve most problems.

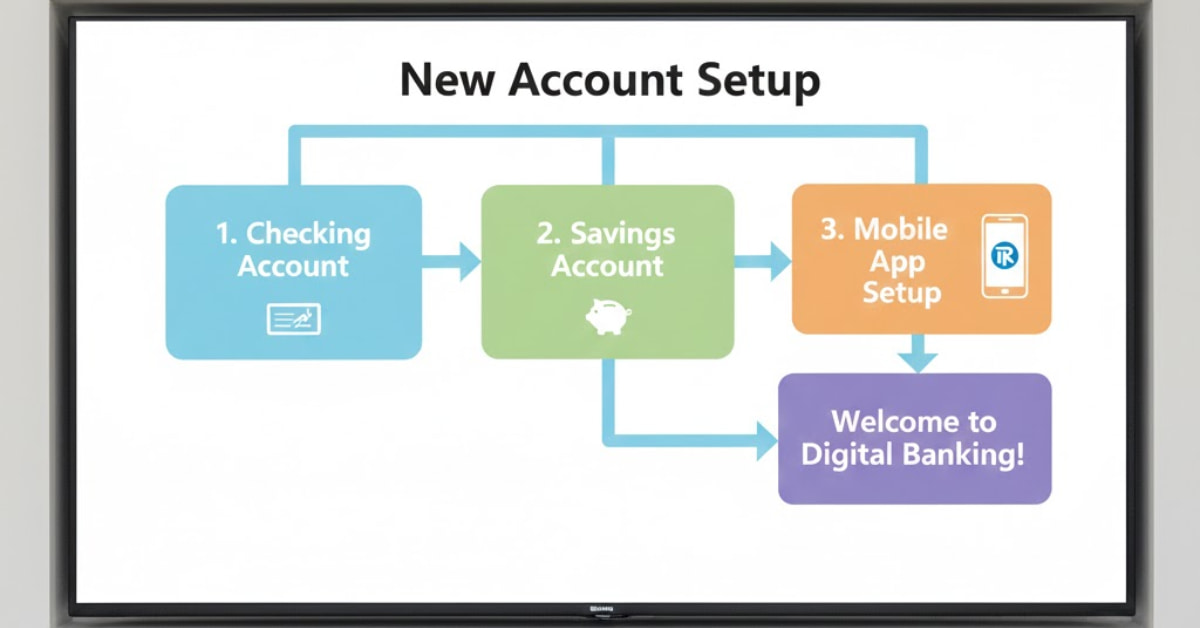

Step-by-Step Guide to Choosing and Setting Up the Right Account

Step 1: Choosing Between Checking and Savings Accounts

Before opening an account, assess your personal financial goals:

-

Compare Rondout Savings Bank checking account vs savings account benefits.

-

Consider fees, interest rates, and transaction limits.

-

Look for perks such as mobile deposits and online fund transfers.

💡 Pro Tip: If you perform frequent transactions, a checking account is essential. For long-term savings, a savings account is ideal.

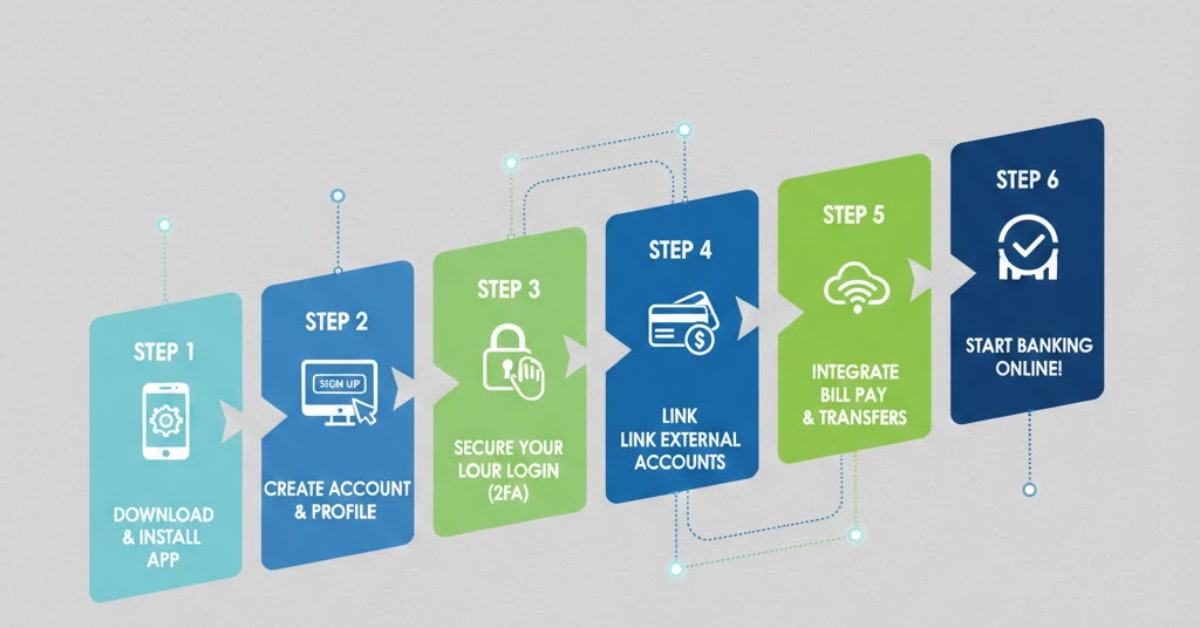

Step 2: Setting Up Online Banking Without Errors

Setting up Rondout Savings Bank online banking requires attention to detail:

-

Visit the official Rondout Savings Bank website or download the mobile app.

-

Have your account number, Social Security number, and personal identification ready.

-

Follow instructions to create secure login credentials.

-

Test all key functions: check balance, transfer funds, and deposit checks.

LSI keywords naturally included: Rondout Savings Bank online banking, Rondout Savings Bank mobile app, Rondout Savings Bank deposit services.

💡 Tip: Enable notifications to stay updated on all transactions in real time.

Step 3: Understanding Loans, Mortgages, and Credit Options

Rondout Savings Bank offers both personal loans and mortgages:

-

Check Rondout Savings Bank mortgage rates online or at a branch.

-

Ask about fees, prepayment options, and eligibility requirements.

-

Consider personal loans only if they match your short-term financial needs.

💡 Pro Tip: Branch staff can provide information about promotional rates or flexible terms not always advertised online.

Step 4: Finding Branches and Confirming Hours

-

Search Rondout Savings Bank branches near me to locate the closest branch.

-

Always confirm hours of operation to avoid wasted trips.

-

Local branches sometimes provide community-specific services and promotions.

Step 5: Common Mistakes to Avoid

From my personal experience, these are the most common errors:

-

Rushing account setup without confirming eligibility.

-

Ignoring app notifications or updates.

-

Overlooking small print on loans or mortgages.

Insider Tips and Hidden Insights Most People Don’t Know About Rondout Savings Bank

Even if you think you know everything about banking, there are some little-known tips that can make your experience smoother. For starters, calling your local branch directly is usually faster than sending an email when you need answers quickly. Some branches also handle deposit services more efficiently than the mobile app, so it’s worth visiting in person for time-sensitive transactions. The Kingston, NY branch often has community-focused programs or local offers that aren’t widely advertised, which can be surprisingly helpful. If you’re thinking about credit cards, make sure to check reward programs and fees carefully before applying. Another insider tip is to ask about small perks or account benefits that staff may not mention unless prompted. Even simple things like deposit cut-off times can save you from unnecessary delays. Paying attention to these little details can make your banking experience with Rondout Savings Bank much smoother and more rewarding.

Who Benefits Most From Rondout Savings Bank and Who Might Want to Look Elsewhere

Ideal Users:

-

People seeking reliable checking and savings accounts.

-

Customers who value personalized service over a purely digital experience.

-

Residents in Kingston, NY and nearby areas looking for local banking benefits.

Who Might Avoid:

-

Individuals who require a nationwide ATM network.

-

Users expecting advanced features beyond the standard mobile app.

Real-Life Strategies for Maximizing Your Experience

From my experience, here are strategies that make banking with Rondout Savings Bank efficient:

-

Use both online and branch resources: Combine mobile banking convenience with in-person assistance.

-

Track accounts regularly: Set up notifications for deposits, withdrawals, and bill payments.

-

Ask questions early: Don’t wait until a problem arises—call customer service or visit the branch.

-

Leverage local perks: Kingston branch sometimes provides community-specific promotions or workshops.

-

Stay updated on rates: Monitor mortgage rates, personal loans, and savings interest rates regularly.

Step-by-Step Process to Apply for a Loan or Mortgage

-

Visit the bank branch or the Rondout Savings Bank website.

-

Gather all necessary documents: proof of income, ID, account info.

-

Speak with a loan officer to understand eligibility and terms.

-

Review rates carefully and compare with other local banks.

-

Submit application and follow up regularly with the branch.

💡 Pro Tip: Ask about special rates or promotions for local residents.

Behind the Scenes: Small Issues You May Face

Overall, my experience with Rondout Savings Bank was positive, but no bank is perfect, and it’s worth sharing a few small limitations. During the initial mobile app setup, I ran into minor glitches that caused a bit of frustration. I also noticed that nationwide ATM access is somewhat limited compared to larger national banks, which could be inconvenient if you travel frequently. Some of the loan information wasn’t immediately clear, so I had to make multiple calls to fully understand the details. These might seem like small issues, but being aware of them sets realistic expectations. On the bright side, customer service was helpful in resolving problems quickly. Even with these minor imperfections, the bank’s services remained reliable and practical. Accepting small hiccups as part of the experience makes banking here much smoother.

Final Thoughts: Calm, Practical Advice from My Experience

After spending time using Rondout Savings Bank, I can honestly say it’s a trustworthy, community-focused bank. They offer essential services like checking accounts, savings accounts, loans, mortgages, and online banking, and most of them work smoothly once you know the ropes. From my experience, a little patience, careful research, and proactive communication with staff goes a long way in avoiding small mistakes or confusion. Even if minor hiccups happen, staying calm and informed makes banking here straightforward and stress-free. Overall, with the right approach, you can maximize the benefits of your accounts while feeling confident and in control of your finances.