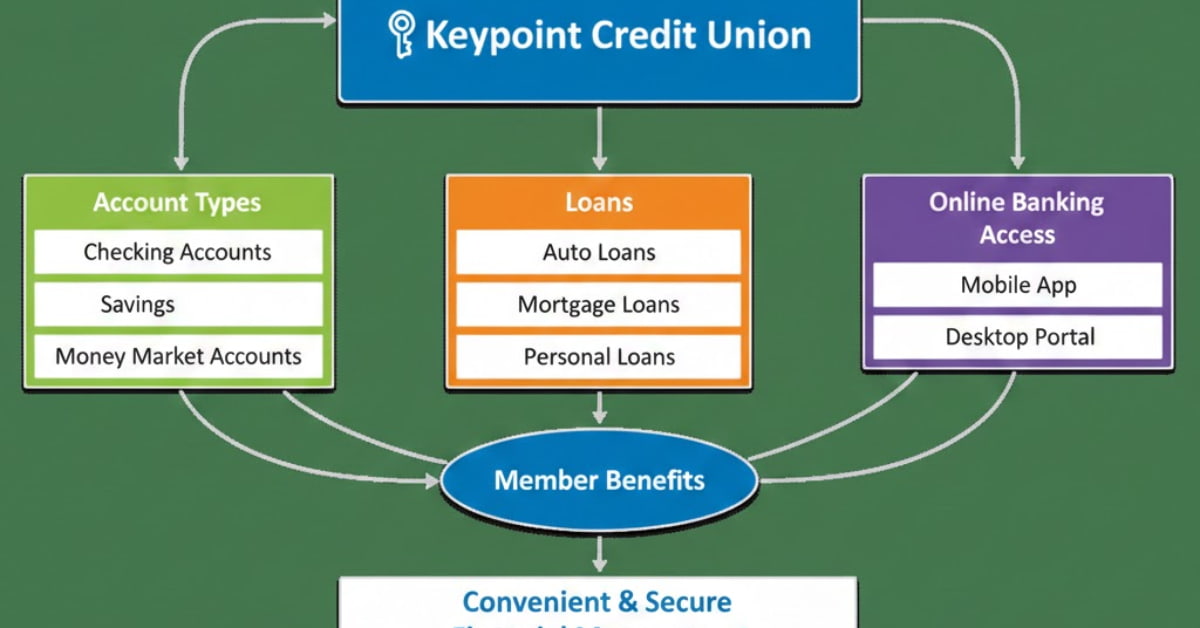

Explore Keypoint Credit Union’s accounts, loans, online banking, and member services. Get practical tips, hidden insights, FAQs, and step-by-step guidance for real financial benefits.

My First Encounter with Keypoint Credit Union

I’ll admit—I was hesitant the first time I considered Keypoint Credit Union. I had been with a traditional bank for years, and the idea of switching to a credit union felt daunting. I remember sitting at my laptop, staring at the Keypoint Credit Union login page, feeling a bit overwhelmed. What if I entered my routing number wrong? What if I couldn’t figure out how to use their online banking?

At first, I made some mistakes:

-

I tried logging in multiple times with the wrong credentials.

-

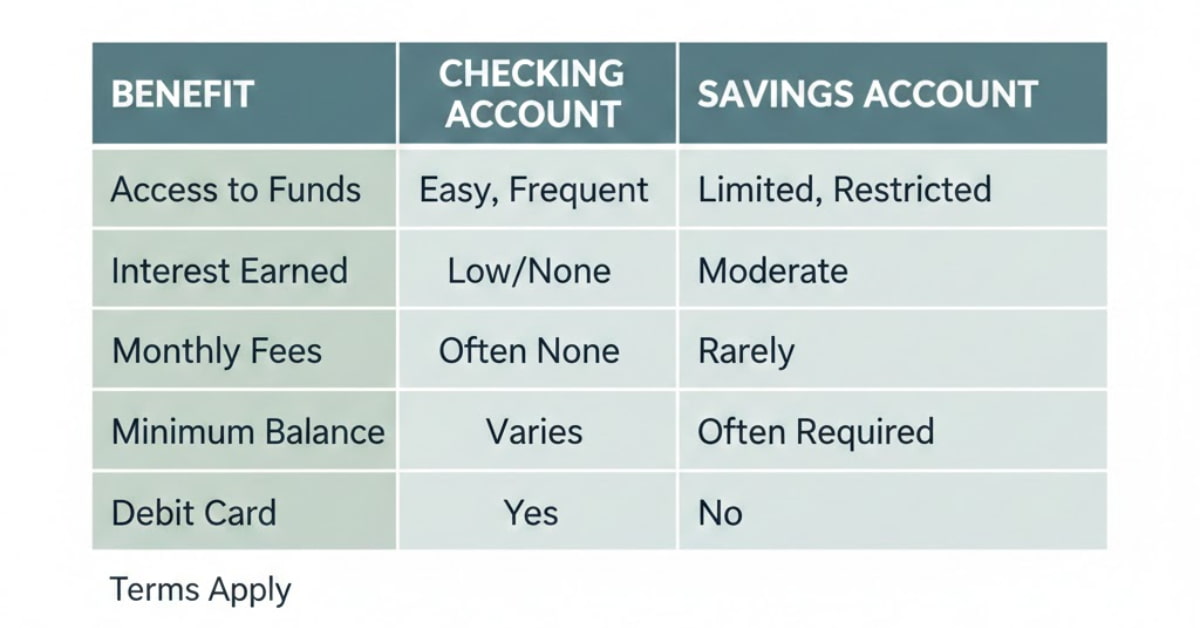

I didn’t fully understand the difference between savings and checking accounts.

-

I got confused when exploring loan options and credit cards.

But I quickly realized that once I spent some time exploring, things started to make sense. The website is straightforward, and customer service is genuinely helpful. By the end of that first day, I felt like I was starting to get a handle on it.

From Confusion to Confidence

After my initial struggle, I went through a learning curve. Here’s how my feelings changed:

-

Confusion → Clarity: I learned that checking accounts are best for daily spending and bills, while savings accounts are perfect for long-term growth.

-

Doubt → Confidence: Logging in via the mobile app became easy once I understood the navigation.

-

Stress → Relief: Understanding loan types, mortgage rates, and credit cards helped me plan finances efficiently.

It felt like I had unlocked a new level of financial control. And the best part? Once I mastered the basics, using Keypoint Credit Union became second nature.

What Didn’t Work Perfectly (And My Honest Struggle)

To be completely honest, not everything went smoothly for me. Before starting, I assumed the process would be simple, but once I was actually in it, I realized there were a few real challenges along the way. The mobile app, for example, sometimes lagged—especially during peak hours. There were moments when I had to wait longer than expected, and I found myself wondering whether the issue was temporary or just part of the system.

Setting up multiple accounts also took more time than I had anticipated. Even though the steps seemed clear on paper, I still made a few small mistakes while filling out forms or submitting information. Those minor errors meant rechecking details, resubmitting documents, and spending extra time fixing things I thought I had already completed.

The most stressful part, however, was understanding the loan eligibility requirements. At first, the criteria felt confusing and slightly overwhelming. I wasn’t sure if I qualified, whether my documents were enough, or if I was missing something important. That uncertainty definitely caused some anxiety early on.

But over time, I realized something important: these issues aren’t unique to me. Many people experience similar struggles when switching banks or credit unions. The key lesson I learned was not to rush the process. Taking things step by step, asking questions, and reaching out to member services when needed made a huge difference. Moving slowly and carefully may take a bit more time, but it helps avoid unnecessary mistakes, stress, and frustration in the long run.

Step-by-Step Guide: How I Made the Most of Keypoint Credit Union

Here’s a detailed, practical approach based on my experience:

Step 1: Setting Up Online Banking

-

Visit the Keypoint Credit Union website.

-

Click on Online Banking Login.

-

Enter your credentials carefully, along with your routing number.

-

Download the mobile app to manage accounts on the go.

Pro Tip: Enable two-factor authentication to add an extra layer of security.

Step 2: Choosing the Right Account

When I first joined, I struggled with deciding between checking and savings accounts. Here’s what helped:

-

Savings Account: Ideal for building an emergency fund or growing your balance with interest.

-

Checking Account: Best for daily spending, bill payments, and direct deposits.

-

Combined Approach: Open both accounts for maximum flexibility.

Common Mistakes:

-

Opening multiple accounts without a plan—this can be confusing and might lead to unnecessary fees.

-

Not checking interest rates or account requirements before committing.

Step 3: Applying for Loans & Credit Cards

I also wanted to explore loans and credit options. Here’s how I navigated it:

-

Personal Loans: Great for consolidating debt or handling unexpected expenses.

-

Auto Loans: Check rates carefully and compare monthly payments.

-

Mortgage Loans: Keypoint Credit Union offers competitive mortgage rates; plan ahead and review eligibility.

-

Credit Cards: Look for low-interest options and rewards that match your spending habits.

Tips from Experience:

-

Apply online for faster approval.

-

Have necessary documents ready, like ID, proof of income, and account information.

-

Read terms carefully to avoid surprises.

Who Benefits Most: People buying homes, cars, or needing flexible personal loans.

Who Should Avoid: Those looking for highly specialized investment services, as credit unions are limited compared to big banks.

Step 4: Accessing Member Services

I quickly realized that member services are a goldmine for answers:

-

Call the contact number for guidance on any account or loan.

-

Check branch locations and hours to plan visits efficiently.

-

Use ATM locations to save time and avoid fees.

Pro Tip: Keep the app and website handy for quick questions; many solutions are available online.

Hidden Insights Most People Don’t Share

At first, I completely overlooked automatic savings transfers, thinking I’d manage my savings manually—but once I set it up, my balance started growing quietly in the background without any extra effort. One thing that genuinely surprised me was the lower loan rates; compared to traditional banks, credit unions like Keypoint often feel more member-friendly when it comes to interest and repayment terms. What most people don’t talk about is the ownership model—credit unions are member-owned, which really changes how you’re treated as a customer. Instead of feeling like just another account number, the service felt more personal and transparent. I also noticed fewer unexpected charges, which made budgeting easier and less stressful. Over time, these small advantages added up more than I expected. Looking back, these are the kinds of benefits people usually discover only after joining.

Additional Tips for Maximizing Keypoint Credit Union Benefits

-

Track Your Expenses: Use the mobile app to monitor spending and avoid overdrafts.

-

Take Advantage of Online Tools: Budget calculators, loan estimators, and account alerts help plan better.

-

Stay Updated: Sign up for email notifications about rate changes, new services, and promotions.

These small steps made a huge difference in my financial management and confidence.

Frequently Asked Questions (FAQs)

Q1: How do I reset my Keypoint Credit Union login password?

A: Go to the login page, click Forgot Password, and follow instructions sent to your registered email.

Q2: What is the routing number for Keypoint Credit Union?

A: The routing number is unique to your state and account type. Check your checks or the website.

Q3: Can I access my accounts via mobile app?

A: Yes! Download the Keypoint Credit Union app, log in, and manage your accounts on the go.

Q4: What loans are available?

A: Personal loans, auto loans, mortgages, and credit cards with competitive rates.

Q5: How do I find the nearest branch or ATM?

A: Visit the website or app, navigate to Branch & ATM Locator, and enter your ZIP code.

Q6: Can I automate savings or bill payments?

A: Absolutely! Automation makes managing finances stress-free and consistent.

Q7: Are there hidden fees?

A: Credit unions are generally transparent, but always review account terms to avoid surprise fees.

Conclusion

Switching to Keypoint Credit Union transformed the way I manage money. From exclusive accounts and loans to easy online banking and helpful member services, everything became more manageable.

Here’s what you can do today:

-

Set up your online banking account

-

Download the Keypoint Credit Union mobile app

-

Explore loans and credit cards that fit your needs

-

Visit your nearest branch if needed

Even if it feels confusing at first, remember: small steps lead to long-term financial clarity. You’ll thank yourself later!